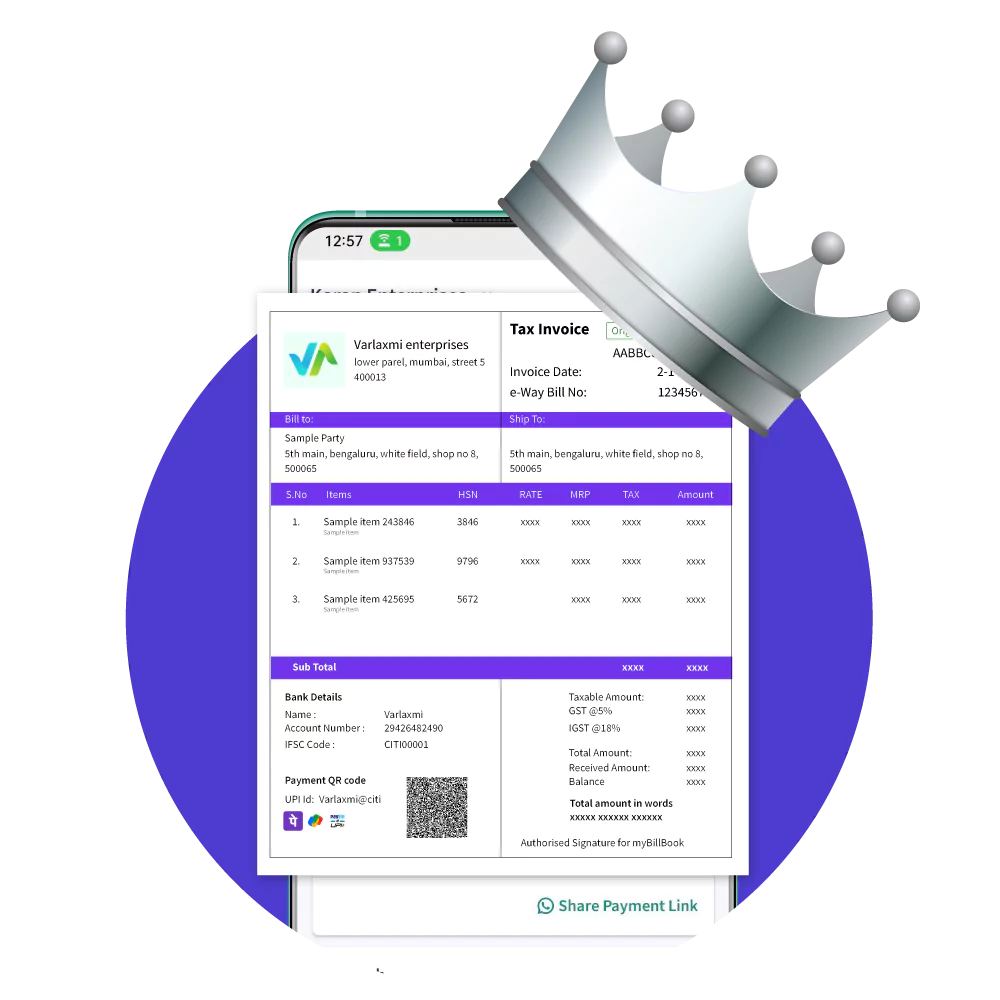

myBillBook offers fully customisable GST invoices with multiple invoice theme options that can comply with GST requirements.

You can easily customise GST bill formats by adding your company’s logo and changing font, colours and other aesthetics that suit your brand identity. The invoices prepared in myBillBook comply with GST by containing all the mandatory fields required under GST.

Set your own invoice prefixes and number sequence.

This means businesses can have a continuous numbering system for their invoices, making it easier to keep track of all invoices. Organisations can easily arrange their invoices by changing the prefix and number digits to streamline their invoicing process.

myBillBook produces e-invoices and e-way bills without any hassles.

With just one click, you can automatically generate e-invoices without visiting the government’s Invoice Registration Portal (IRP). Similarly, you can generate e-way bills directly from the software.

GSTR-1 filing is an important compliance requirement under the GST regime.

myBillbook has simplified this process through the GSTR-1 easy filing feature. Businesses can easily generate GSTR-1 reports directly from the platform instead of compiling and filing forms manually, which takes time and effort. Our system helps streamline GSTR-1 filing, ensuring companies do not default late or file incorrectly, attracting penalties.

In addition to filing GSTR-1, myBillBook provides detailed GSTR-2 and GSTR-3B reports that help businesses track their input tax credit and tax liability.

These reports offer an overview of all GST transactions carried out by the business, making it easier to reconcile the tax credits and liabilities. With these detailed reports and comprehensive information, companies can make sound financial decisions and maintain accurate records.

Tracking paid and unpaid invoices is very important for cash flow management and financial planning.

myBillBook makes tracking simple for businesses through updates on invoice status. From monitoring overdue invoices to keeping track of payments received and taking necessary steps towards managing cash flow efficiently, the billing app does it all.

₹217

Per month. Billed annually

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹217

Per month. Billed annually

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

✅ For 1 device, 1 business and 1 user

₹399 per year

✅ For 1 device, 1 business and 1 user

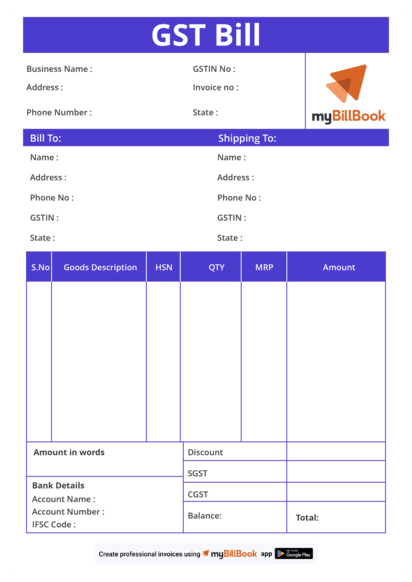

GST invoice format is a standard document layout that records the sale of goods or services and transactions under GST. It includes important details such as the seller’s and buyer’s information, description and quantity of the offered goods or services, applicable tax rates, total amount charged, and other required tax compliance details.

According to GST laws, a tax invoice shall be issued by the registered person containing the following particulars-

Here is a sample GST bill format or template for your reference. The design element can vary based on your brand’s image or other factors, but the content and the fields must follow GST regulations.

Creating a GST bill format in Word is one of the easiest methods. Word is best suitable for small and medium-sized enterprises as it is an affordable and easy-to-use tool. Anyone with basic Word knowledge can use the software to create an invoice template. Here are the steps to create GST invoice format in Word from scratch.

The GST invoice format in Excel is another great way to format invoices. Excel has an extra feature compared to Word, as it allows the insertion of formulas to auto-populate data. This feature is not available in Word, making GST bill formats in Excel a better alternative for accurate billing. Here is how to create a GST bill format using MS Excel-

You can also insert some Excel formulas to auto-populate the cells when creating invoices.

GST-registered businesses have to issue simple GST invoices to customers. If a business is to be compliant with GST, it has to have an invoice numbering system along with GSTIN and a unique serial number on the tax invoice. Each invoice should include details such as the date of the invoice, sender’s and recipient’s information, descriptions of items, quantities, taxable supply values, tax rates applicable on supplies made to customers, amounts payable by customers towards taxes and final value. A simple GST bill format commonly comprises the goods or services supplied and the payment amount due.

Creating invoice format in Word or Excel can be time-consuming and difficult and might not always be the right choice. myBillBook is user-friendly accounting software designed to simplify invoice generation. By offering comprehensive features and an intuitive interface, myBillBook is a better solution for generating GST bills. Here is how to create a GST invoice using myBillBook-

A GST Invoice Template in PDF is the simplest way to send clients a visually appealing and organised invoice. Simply download the GST bill format, customise it with your company and client details, and email or print the invoice to your customer in PDF format. The invoices generated in PDF cannot be edited further, so they are secure. In addition, PDF invoice formats look professional so that users can share them directly with customers.